First of all, figure out if you can actually afford an automobile and pay monthly installments for it and how much you can spend and how long the payments will last.

RHETORICAL QUESTIONS: HOW MUCH CAN YOU MANAGE A MONTH TO SPEND FOR A VEHICLE AND WHAT’S YOUR BUDGET PERMIT?

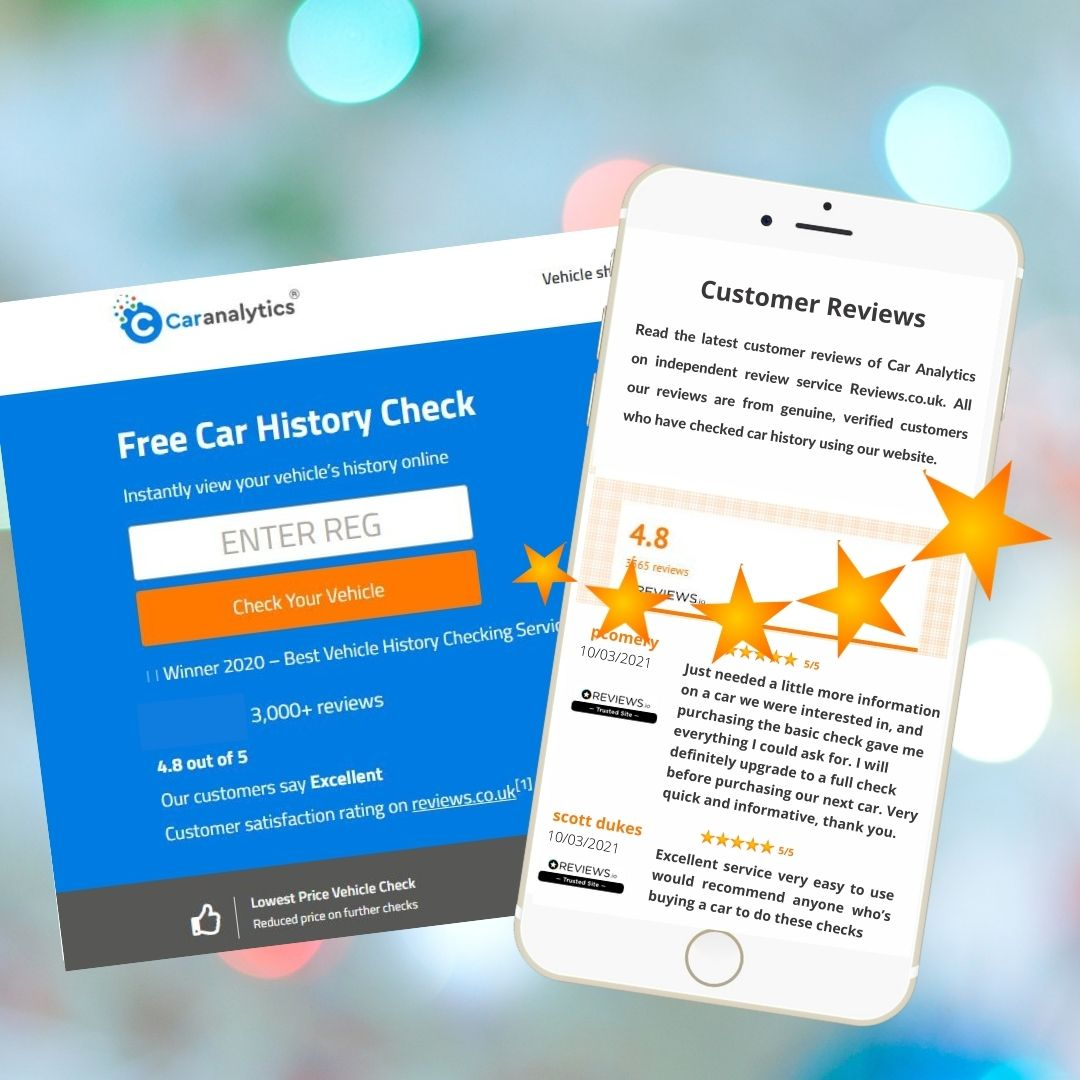

How’s your debt rating? Significant sufficient to rack up the lowest funding rates offered or not so much? Car Analytics lets you alternative of free HPI finance check before buying a used car.

With the arrival of longer loan payment routines, there’s ample chance for you to potentially get to a point where you owe more on the vehicle than it’s worth. Seriously. This scenario surfaces if you end up in a crash and one or both airbags release, as well as possibly you have few years left to pay on the finance. The insurer completes the automobile and delivers what it’s worth. Relying on your financing, the insurance coverage payment could not cover the remaining equilibrium on the lending. In that situation, you still have to pay the lending institution the remaining balance, not an excellent condition to be in.

Talk with your insurance provider and learn what it will cost you to guarantee this desire automobile; how’s your driving document? After that, if it is to be funded, ensure the lender doesn’t need any minimal obligatory or deductibles insurance coverages, like crash and extensive, as this will straight affect your premiums. Never forget to check the outstanding finance of a car while buying a used car.

HOW MUCH CASH YOU INTEND TO PUT DOWN ON THE PURCHASE OF THE CAR

Decide whether you desire an “extended warranty” on the automobile; you’ll need to figure this cost right into the purchase as well as monthly expenses of the car.

And after that, you have the regular upkeep expenses of simply owning and running an item of sophisticated machinery that will require focus, will need fixings as well as will set you back to do so.

Yeah, this isn’t very extravagant or “nuts as well as screws” kind of things, but it’s something plenty of people neglect: MONEY. Many people often tend not to get any suggestion in advance of time what the month-to-month expenses are for a used automobile. When fact strikes, they discover they can’t pay for the car, and they additionally, due to upside-down funding, discover they cannot get rid of it and settle the outstanding car loan.

If you can get the funds exercised beforehand, recognize in advance what this car will cost you gradually as well as monthly, and most significantly, can you afford the regular monthly prices, then the rest of it is cake. There’s all manner of info around about getting a car, both new and used.

WHAT SHOULD YOU AVOID WHILE FINANCING A USED CAR?

Every week, Car Analytics speaks with audiences who have been warded off by making classic car purchasing mistakes without understanding it. Below is a useful list of eight typical mistakes individuals make and tips on avoiding them.

Not Trusting Your Guts

Error leading is not trusting your gut. This is very easy to avoid. Depend on your impulses; you have them for a reason. If something doesn’t feel right, either with the salesperson or business, leave. Make a car history check for free.

- Believing Every Little Thing, You Check Out Online

Error number two is thinking whatever you check out online. A lot of what’s out there is opinion, not reality. So be careful where you go to investigate a car or obtaining car dealership details. You cannot validate it the majority of the time, so try to find a relied on and credible source.

- Hurrying The Documentation Process

Mistake number three is rushing the documentation procedure. Do on your own a favour. Decrease. Review what you sign so you aren’t shocked later on to learn you’ve bought; additionally, you didn’t know about or an extensive guarantee. Documentation bores, however, reviewed it all since you are authorizing a lawful, binding contract.

- Taking An Incorrect Test Drive

Mistake number four is taking an inappropriate test drive. Please do not buy the vehicle of your dreams without driving it. A “comparable” car won’t do. Test drive the one you want to drive off-the-lot with, so you don’t start with issues or neglect essential choices.

- Not Knowing Your Credit Score

Blunder number five is walking right into a dealer without recognizing your credit rating. Know where your credit rating stands. More petite than credible dealerships will try to function bad credit scores to their benefit and might result in you paying a more excellent price and the interest rate.

- Playing Games With The Dealership

Error number six is playing games. Don’t hold back information from a car dealership, like whether you have a trade-in or just how you are spending for the car. Great dealerships will not play games with you, so you shouldn’t play games with them in return.

- Not Knowing Rates Of Interest

Error number seven is not knowing what rate of interest you can get. If you have a financial institution lending institution, find out what price they can provide you. After that, give the dealer the chance to meet or beat the price.

- Leasing When You Shouldn’t

Do not get caught up in a reduced monthly settlement if there is any danger of driving over the mileage limitations. It’ll cost you a king’s ransom, ultimately. Additionally, long-term 42-month leases are a poor suggestion, and Car Analytics never suggest third-party leasing business.

If you can prevent these blunders, you’ll get a better overall bargain as well as a satisfying ownership experience.

Wish to obtain necessary checks for free with a complimentary automobile check?

As you know, all the checks to be done before choosing a utilized vehicle that matches your requirements, you may think of the price of monitoring. Do you recognize that you can check outstanding finance of car in Car Analytics, and this is entirely free?

For your alleviation, a free HPI finance check from Car Analytics gives you comfort by obtaining crucial checks done virtually free. Likewise, to make points better for you, a free vehicle finance check is also included in this report.

Always make a car finance check before purchasing a used car.